Bitcoin Ethereum Solana Drop Price Analysis And Insights

Bitcoin Ethereum Solana drop price sets the stage for an enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The cryptocurrency market has recently seen significant fluctuations, particularly affecting major players like Bitcoin, Ethereum, and Solana. Understanding the factors behind these price drops, including economic conditions, technological developments, and market sentiment, can provide crucial insights for investors navigating these turbulent waters.

As we delve deeper into the current trends and historical movements of these cryptocurrencies, we will highlight the macroeconomic influences, regulatory changes, and technological advancements that have shaped their market trajectories. This comprehensive examination aims to equip both seasoned traders and newcomers with the knowledge needed to make informed decisions in a rapidly evolving landscape.

Market Overview

The cryptocurrency market has seen significant fluctuations recently, with notable price drops in Bitcoin, Ethereum, and Solana. As investors closely monitor the market movements, understanding the trends and underlying factors is crucial for making informed decisions. Bitcoin, the leading cryptocurrency, faced a sharp decline, falling below the psychological barrier of $30,000. Ethereum, too, has seen similar setbacks, dropping from its peak of $4,000 to around $2,500.

Solana, initially celebrated for its rapid transaction speeds, has also experienced a downturn, with prices sinking from over $200 to around $50. These price movements highlight the volatility that characterizes the crypto market.Several factors have contributed to these price drops. Increased regulatory scrutiny, macroeconomic pressures, and changing investor sentiment have all played roles. A comparative analysis of historical price movements shows that these cryptocurrencies have faced similar downturns in the past, often recovering over time but not without significant volatility.

Economic Factors

The cryptocurrency market is not isolated from the broader economic environment. Macroeconomic factors such as interest rates and inflation significantly influence the prices of Bitcoin, Ethereum, and Solana. Higher interest rates can lead to reduced liquidity in the market, compelling investors to shift their assets to more stable investments.Inflation, on the other hand, can drive investors towards cryptocurrencies as a hedge against currency devaluation.

For instance, during the inflationary period of 2021, Bitcoin saw a surge in demand as investors sought to preserve their value. However, as inflation rates stabilized, interest in cryptocurrencies waned, contributing to recent price drops.Economic events, such as the Federal Reserve's monetary policy changes, have previously impacted these cryptocurrencies. The announcement of interest rate hikes often leads to market sell-offs, affecting the prices of digital assets.

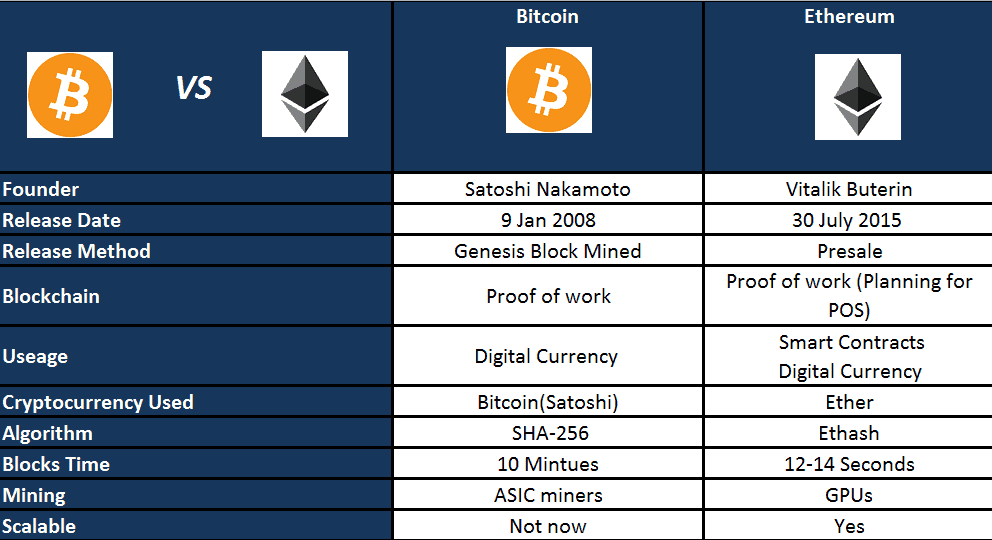

Technological Developments

Technological advancements play a pivotal role in shaping the price dynamics of cryptocurrencies. For Bitcoin, innovations in blockchain technology, such as the Lightning Network, aim to enhance transaction speeds and scalability. Ethereum's transition to a proof-of-stake consensus mechanism is designed to make it more energy-efficient, yet these transitions often come with market uncertainty during their implementation periods.Solana has gained attention for its high throughput and low transaction costs, making it competitive in the DeFi space.

However, network outages and subsequent concerns about reliability have affected its price stability. Scalability and transaction speed remain critical factors for these cryptocurrencies, influencing investor confidence and market attractiveness.

Market Sentiment

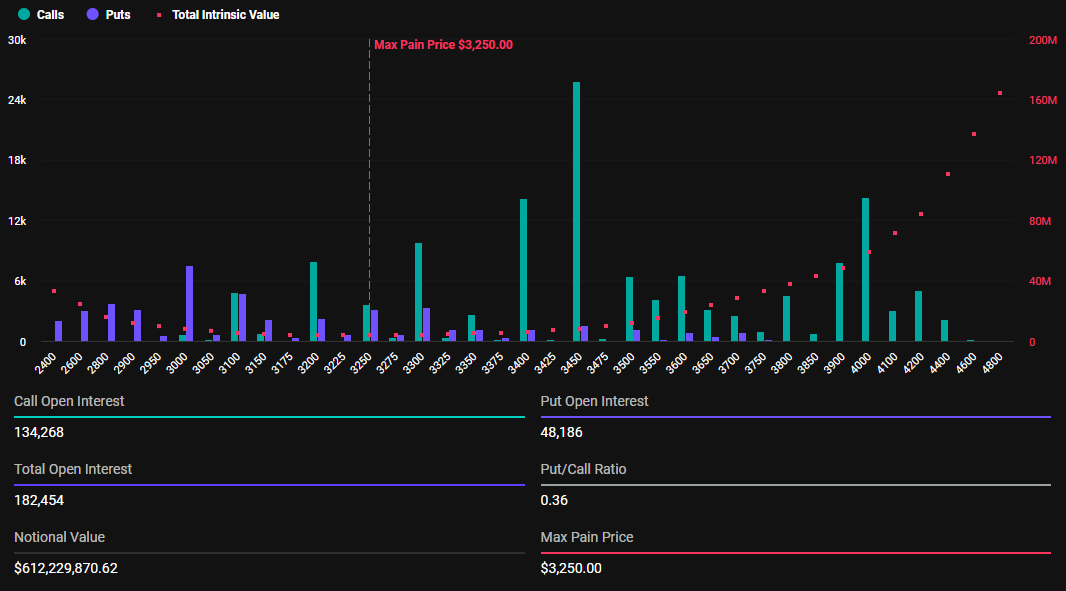

Investor sentiment plays a crucial role in driving prices for Bitcoin, Ethereum, and Solana. Positive news can lead to bullish trends, while negative developments often trigger sell-offs. Social media trends increasingly correlate with price movements, as platforms like Twitter and Reddit have become focal points for discussions around cryptocurrencies.Recent data indicates that spikes in social media mentions of Bitcoin correspond with price increases, highlighting the power of market sentiment.

Similarly, negative media coverage can lead to panic selling, further exacerbating price declines. The relationship between news cycles and market behavior underscores the importance of sentiment analysis in cryptocurrency trading.

Regulatory Environment

Government regulations significantly influence the cryptocurrency landscape. Recent regulatory changes, particularly in major markets like the United States and China, have had profound implications on Bitcoin, Ethereum, and Solana. Countries adopting restrictive stances, such as China’s crackdown on crypto mining and trading, have led to substantial price drops.Conversely, nations that embrace cryptocurrencies, like El Salvador's adoption of Bitcoin as legal tender, can bolster market confidence and drive prices higher.

Understanding the regulatory environment is vital for investors navigating the complexities of the cryptocurrency market.

Investment Strategies

When facing price drops in Bitcoin, Ethereum, and Solana, investors can adopt various strategies to mitigate risks. A diversified portfolio can help cushion against volatility, while dollar-cost averaging allows investors to purchase cryptocurrencies at regular intervals, reducing the impact of price fluctuations.Risk management techniques are essential, especially in a bear market. Setting stop-loss orders can prevent further losses, while taking profits during bullish trends can secure gains.

Long-term investment approaches may offer opportunities to capitalize on market recovery, while short-term trading can exploit price volatility for quick returns.

Future Predictions

Expert predictions regarding the future prices of Bitcoin, Ethereum, and Solana vary widely, reflecting the inherent uncertainty of the cryptocurrency market. Some analysts foresee a recovery in prices as macroeconomic conditions stabilize, while others warn of potential further declines due to ongoing regulatory pressures.Potential scenarios that could affect these cryptocurrencies include advancements in blockchain technology, changes in investor sentiment, or significant economic events.

A comparison of expert forecasts reveals a spectrum of opinions, with some expecting Bitcoin to reach new highs of $100,000 within the next few years, while others predict a bearish trend could persist.

| Expert | Bitcoin Prediction | Ethereum Prediction | Solana Prediction |

|---|---|---|---|

| Analyst A | $100,000 by 2025 | $7,000 by 2024 | $150 by 2025 |

| Analyst B | $50,000 within a year | $4,500 in 2024 | $80 in 2023 |

| Analyst C | $30,000 if bearish trends continue | $2,000 if regulatory issues persist | $40 if market sentiment worsens |

Final Review

In conclusion, the ongoing price drops of Bitcoin, Ethereum, and Solana reflect a complex interplay of market dynamics, investor sentiment, and external economic factors. While the current landscape may seem daunting, understanding these elements can empower investors to strategize effectively for both short-term and long-term gains. As we look to the future, the resilience of these cryptocurrencies will be tested, but with informed predictions and adaptive strategies, opportunities for recovery may emerge on the horizon.

FAQs

What caused the recent price drop of Bitcoin?

The recent price drop of Bitcoin can be attributed to a combination of macroeconomic factors, regulatory news, and shifts in investor sentiment.

Are Ethereum and Solana following Bitcoin's price trends?

Yes, Ethereum and Solana often follow Bitcoin's trends due to its influence on the overall cryptocurrency market.

How can investors protect themselves during price drops?

Investors can employ risk management techniques such as stop-loss orders, diversification, and careful analysis of market conditions.

What role does technology play in the price fluctuations of these cryptocurrencies?

Technological advancements, such as network upgrades and scalability improvements, can significantly impact the perceptions and value of cryptocurrencies.

Is it advisable to invest in cryptocurrencies during downturns?

Investing during downturns can be strategic, but it is crucial to conduct thorough research and assess one's risk tolerance.