Bitcoin And Ethereum Are Examples Of Digital Currencies

Bitcoin and Ethereum are examples of digital currencies that have revolutionized the way we perceive money and transactions in the modern world. Over the years, both cryptocurrencies have carved out their unique identities, attracting global attention and investment while sparking discussions about their potential to reshape financial systems. Understanding their origins, unique features, and the communities behind them is essential for anyone interested in the evolving landscape of cryptocurrency.

This exploration will delve into the origins of Bitcoin and Ethereum, their distinct functionalities, and how they compare in terms of investment potential and future prospects. By examining the technology, community support, and regulatory challenges that both cryptocurrencies face, we can gain better insights into their roles in the digital economy.

Overview of Bitcoin and Ethereum

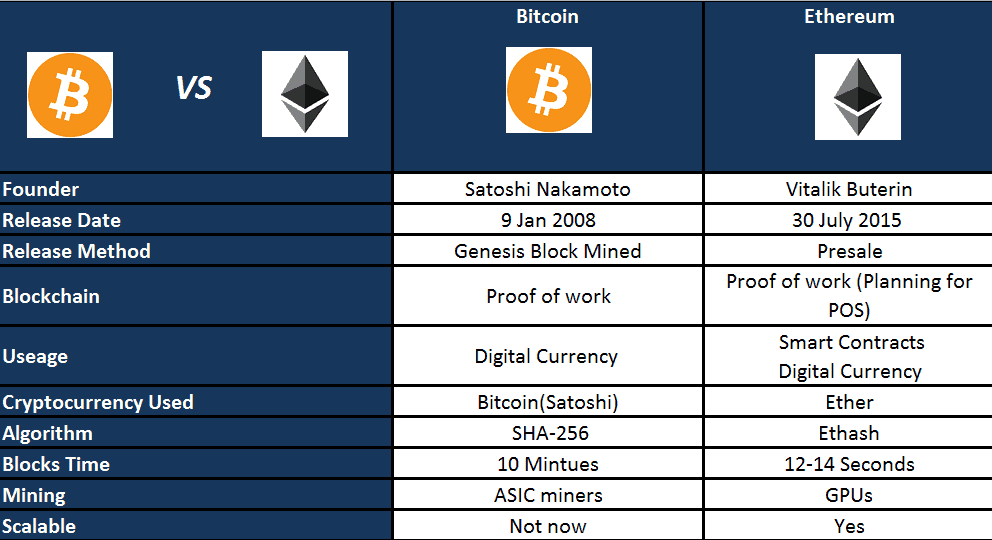

Bitcoin and Ethereum are two of the most prominent cryptocurrencies in the digital currency market, each serving distinct purposes and functionalities. Bitcoin, created in 2009, was the first cryptocurrency and introduced the concept of decentralized digital currency to the world. On the other hand, Ethereum was launched in 2015 with the aim of extending blockchain technology beyond simple transactions, enabling the creation of decentralized applications through its smart contracts.Bitcoin originated from the mysterious figure known as Satoshi Nakamoto, who sought to create a peer-to-peer electronic cash system that operates without a central authority.

Ethereum, proposed by Vitalik Buterin, aims to provide a platform where developers can build applications that leverage blockchain technology, ultimately focusing on programmability and versatility. Both cryptocurrencies have their unique functions: Bitcoin primarily acts as a store of value and medium of exchange, while Ethereum serves as a platform for decentralized applications (dApps) and smart contracts.

Key Features of Bitcoin

Bitcoin is known for its distinctive characteristics that set it apart in the cryptocurrency landscape.

- Decentralized Nature: Bitcoin operates on a decentralized network, meaning no single entity or government controls it. This decentralization enhances security and trust among users.

- Security Mechanisms: Bitcoin transactions are secured through cryptographic techniques. Each transaction is recorded on a public ledger called the blockchain, ensuring transparency and preventing double-spending.

- Scalability Issues: Despite its advantages, Bitcoin faces challenges regarding scalability. The network can handle a limited number of transactions per second, leading to potential delays and increased fees during peak times.

Key Features of Ethereum

Ethereum introduces innovative features that extend its capabilities beyond just digital currency.

- Smart Contracts: One of Ethereum's standout features is its smart contracts. These self-executing contracts with the terms of the agreement directly written into code enable automation and trustless transactions.

- Blockchain Differences: Ethereum's blockchain is designed to be more flexible than Bitcoin's. It allows for complex programming, enabling developers to create a wide range of applications.

- Transition to Proof-of-Stake: Ethereum is in the process of transitioning from a proof-of-work system to a proof-of-stake consensus mechanism. This shift aims to make the network more energy-efficient and secure.

Comparison between Bitcoin and Ethereum

Understanding the differences between Bitcoin and Ethereum provides insight into their functionalities and market positioning.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Transaction Speed | Average 10 minutes | Average 15 seconds |

| Consensus Mechanism | Proof-of-Work | Transitioning to Proof-of-Stake |

| Unique Use Cases | Digital gold, store of value | Decentralized applications, smart contracts |

Investment Perspectives

The market trends surrounding Bitcoin and Ethereum investments reveal the dynamics of the cryptocurrency landscape.

- Market Trends: Bitcoin has traditionally been viewed as a safe haven asset, often referred to as "digital gold." Ethereum, while also experiencing significant growth, is more closely tied to the development of decentralized applications.

- Risk Factors: Investing in cryptocurrencies involves inherent risks, including market volatility, regulatory changes, and technological vulnerabilities. Both Bitcoin and Ethereum are not immune to these challenges.

- Growth Potential: Bitcoin's limited supply may contribute to its long-term value increase, while Ethereum's expanding ecosystem and utility may drive its growth, especially with the rise of decentralized finance (DeFi).

Community and Ecosystem

The communities that support Bitcoin and Ethereum play a crucial role in their development and adoption.

- Supporting Communities: Both Bitcoin and Ethereum have large, active communities that contribute to their ecosystems. These communities include developers, investors, and enthusiasts who advocate for their respective currencies.

- Role of Developers: Developers are vital in enhancing the functionality and security of both platforms. Their contributions can lead to upgrades, new features, and overall improvements to the networks.

- Popular Projects: Ethereum has seen a surge in popular projects, such as decentralized finance platforms and non-fungible tokens (NFTs), showcasing its versatility and adaptability in various industries.

Legal and Regulatory Considerations

The legal and regulatory landscape significantly impacts Bitcoin and Ethereum's growth and adoption.

- Regulatory Landscape: Bitcoin faces scrutiny from governments worldwide due to its potential use in illegal activities. Regulations can vary widely between countries, affecting Bitcoin's viability.

- Smart Contract Regulations: Ethereum's smart contracts are also under regulatory scrutiny, as the legal status of these contracts remains ambiguous in many jurisdictions.

- Legal Challenges: Both cryptocurrencies encounter legal hurdles, such as compliance with anti-money laundering (AML) and know your customer (KYC) regulations, which can complicate their use in different regions.

Future Prospects

The future of Bitcoin and Ethereum is filled with potential technological advancements and market growth.

- Technological Advancements for Bitcoin: Future developments may include scaling solutions like the Lightning Network, which aims to enhance transaction speeds and reduce fees.

- Ethereum's Roadmap: Ethereum's roadmap includes the continued rollout of Ethereum 2.0, focusing on sustainability, scalability, and security improvements.

- Predicted Market Trends: Market analysts often predict strong growth for both cryptocurrencies, driven by increased adoption, institutional interest, and technological innovations.

Conclusive Thoughts

In conclusion, Bitcoin and Ethereum are not just examples of cryptocurrencies; they represent the forefront of financial innovation that holds the promise of disrupting traditional systems. By understanding their unique features and the ecosystems that support them, investors and enthusiasts alike can make informed decisions in a rapidly changing market. As we look to the future, the evolution of these digital currencies will undoubtedly continue to shape our financial landscape.

Top FAQs

What are the main differences between Bitcoin and Ethereum?

Bitcoin primarily functions as a digital currency, while Ethereum serves as a platform for building decentralized applications through smart contracts.

How secure are Bitcoin and Ethereum transactions?

Both Bitcoin and Ethereum utilize blockchain technology, which provides high levels of security; however, users must also take personal security measures to protect their wallets.

Can I invest in Bitcoin and Ethereum simultaneously?

Yes, many investors choose to diversify their portfolios by investing in both Bitcoin and Ethereum to balance their risk and potential returns.

What is the significance of smart contracts in Ethereum?

Smart contracts automate and enforce agreements without the need for intermediaries, making transactions on the Ethereum network more efficient and transparent.

Are there regulatory concerns regarding Bitcoin and Ethereum?

Yes, both cryptocurrencies face various legal and regulatory challenges across different regions, which can impact their adoption and market performance.