Bitcoin Ethereum Options Expire Trading Insights

Kicking off with bitcoin ethereum options expire, understanding how options work in the cryptocurrency space is essential for traders looking to maximize their potential profits.

Options trading offers unique opportunities and risks for Bitcoin and Ethereum, each bringing its own characteristics to the market. As expiration dates approach, the dynamics shift, making it crucial to grasp how these elements interact and influence trading strategies.

Overview of Bitcoin and Ethereum Options

Bitcoin and Ethereum options are financial derivatives that allow traders to speculate on the future price movements of these cryptocurrencies without actually owning them. An option gives the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price before a specific date. Bitcoin options are primarily based on BTC’s price, while Ethereum options focus on ETH.

The fundamental difference lies in the underlying assets and how their market dynamics operate. Options play a significant role in the cryptocurrency markets by providing traders with the ability to hedge against price fluctuations, enhancing liquidity, and allowing for strategic trading approaches.

Fundamental Concepts

Options trading revolves around two main types: call options, which give the buyer the right to purchase the underlying asset, and put options, which allow for selling. Both Bitcoin and Ethereum options are traded on various exchanges, offering different contract terms and strike prices. The significance of these options in the cryptocurrency market cannot be overstated; they serve both as a risk management tool and a speculative instrument, enabling traders to navigate the inherent volatility of cryptocurrencies.

Mechanism of Options Expiration

Options expiration refers to the date when options contracts become void and can no longer be exercised. For Bitcoin and Ethereum, this process is crucial as it can lead to significant market movements. As expiration approaches, traders may adjust their positions based on anticipated market behavior.

Options Expiration Process

When an option expires, if it is in the money, the holder can exercise it for profit. Conversely, if it is out of the money, it becomes worthless. For example, if a trader holds a Bitcoin call option with a strike price of $60,000 and Bitcoin is trading at $65,000 at expiration, the option will be exercised. This activity can lead to increased volatility in the market as traders react to the expiration of their contracts, adjusting their strategies accordingly.

Historical Trends in Options Expiration

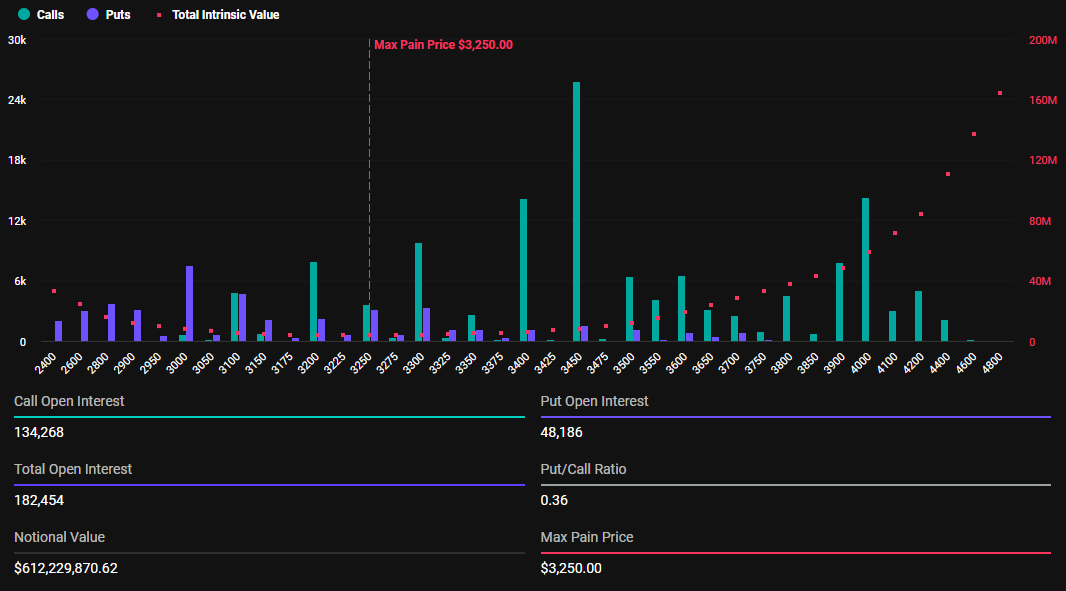

Examining the historical data surrounding Bitcoin and Ethereum options expiration reveals patterns that traders often leverage to inform their strategies. Significant market reactions have been observed on expiration dates, often leading to notable price swings.

Market Reactions

During past expirations, Bitcoin and Ethereum have shown strong correlations between options expiration and price volatility. For instance, a surge in open interest leading up to an expiration date often results in increased buying or selling pressure, which can significantly impact prices. Patterns observed indicate that traders may anticipate price movements based on the volume of options set to expire.

Strategies for Trading Around Expiration Dates

As options expiration approaches, traders typically adopt specific strategies to maximize their outcomes. Understanding these strategies is essential for navigating the complexities of options trading.

Guide to Strategies

Traders might consider several approaches as expiration dates near:

- Rolling Over: Instead of closing positions, traders can roll their options to a later expiration date, maintaining their exposure.

- Hedging: Implementing hedging strategies using options can help mitigate potential losses in underlying positions.

- Market Sentiment Analysis: Analyzing market sentiment can provide insights into potential price movements leading up to expiration.

Additionally, risk management techniques, such as setting stop-loss orders, become increasingly important during this period to protect against adverse market movements.

Impact of Options Expiration on Price Volatility

The expiration of options has a profound impact on price volatility for both Bitcoin and Ethereum. Increased activity surrounding expiration dates often leads to heightened price fluctuations.

Volatility Analysis

The correlation between options volume and price movement around expiration is notable. Higher volumes tend to amplify volatility, creating opportunities and risks for traders. Market sentiment also plays a crucial role; bullish or bearish sentiments can exacerbate price movements as expiration approaches, leading to rapid changes in market direction.

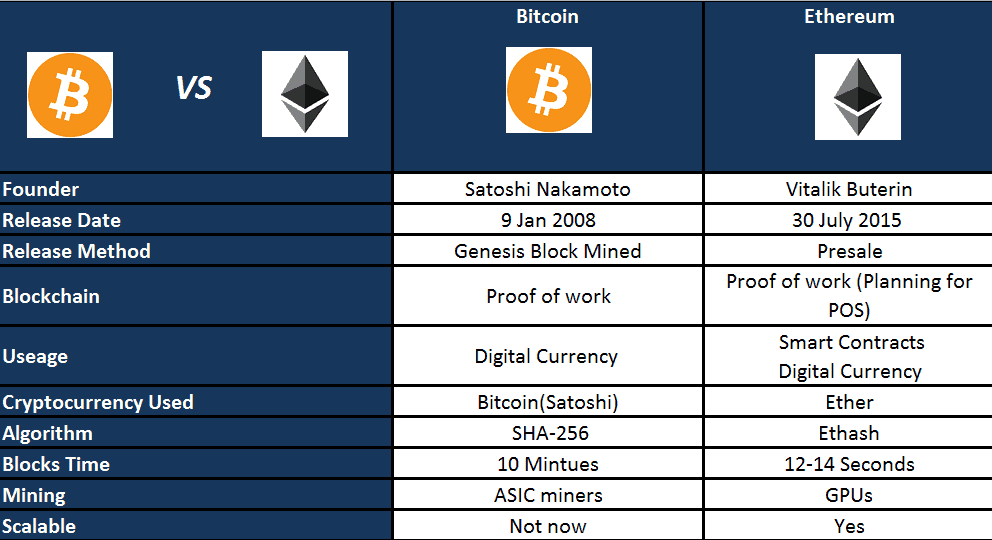

Comparison of Bitcoin and Ethereum Options Markets

When comparing the options markets for Bitcoin and Ethereum, significant differences in trading volume and liquidity emerge. Understanding these distinctions is vital for traders looking to navigate these markets effectively.

Market Behavior Analysis

Bitcoin options typically exhibit higher trading volumes, reflecting its status as the leading cryptocurrency. Ethereum options, while growing, may show different patterns in behavior, particularly during expiration events.

- Bitcoin tends to attract larger institutional participation, leading to more stable price movements.

- Ethereum’s options market can experience more volatility, influenced by its unique developments and market conditions.

Traders must recognize these differences to tailor their strategies accordingly.

Regulatory Considerations for Options Trading

The regulatory landscape surrounding Bitcoin and Ethereum options trading is evolving, with various compliance requirements for traders and exchanges.

Compliance Requirements

Traders must be aware of regulations imposed by governing bodies, as these can impact trading practices and market access. Compliance may involve adhering to reporting standards and ensuring that trading activities align with legal frameworks. The evolving nature of regulations also poses challenges and opportunities for market participants, shaping their strategies and market engagement.

Future Trends in Bitcoin and Ethereum Options

Looking ahead, the future of options trading in Bitcoin and Ethereum is promising, driven by technological advancements and changing market dynamics.

Predictions and Emerging Trends

The integration of new technologies, such as blockchain innovations, is expected to enhance the efficiency of options trading. Furthermore, the introduction of decentralized finance (DeFi) platforms may create new opportunities for traders. As the market matures, trends such as increased participation from institutional investors and the development of more sophisticated trading tools will likely shape the landscape. Traders must remain adaptable and informed to leverage these trends effectively.

Last Word

In summary, the interplay between bitcoin ethereum options expire and market volatility is a fascinating area for traders to explore. By recognizing the trends and strategies surrounding options expiration, traders can better position themselves to navigate the complexities of the cryptocurrency market.

Detailed FAQs

What happens when bitcoin or ethereum options expire?

Upon expiration, options either get exercised or become worthless, impacting the market prices of the underlying cryptocurrencies.

How can traders prepare for options expiration?

Traders can implement strategies such as adjusting positions, managing risk, and analyzing market sentiment as expiration approaches.

What are the risks associated with options trading?

Risks include the potential for significant losses if options expire worthless and market volatility leading up to expiration.

How do market sentiments affect options expiration?

Market sentiments can drive price movements before and after expiration, impacting trader behavior and market volatility.

Are there regulatory considerations for options trading?

Yes, traders must adhere to compliance requirements and understand the regulatory landscape, which varies by region.