Bitcoin Ether Etf Outflows A Closer Look At Trends

As bitcoin ether etf outflows takes center stage, we’re diving into a landscape that reflects both the investment landscape and the pulse of the cryptocurrency market. This exploration reveals the intricate dynamics at play, shedding light on how these outflows can shape investor sentiment and market prices.

Bitcoin and Ether ETFs, designed as investment vehicles allowing exposure to these cryptocurrencies, have gained popularity among investors. However, recent trends suggest a notable shift, with outflows raising questions about market health and future prospects. In this discussion, we will break down what these outflows mean and their implications for investors and the broader market.

Overview of Bitcoin and Ether ETFs

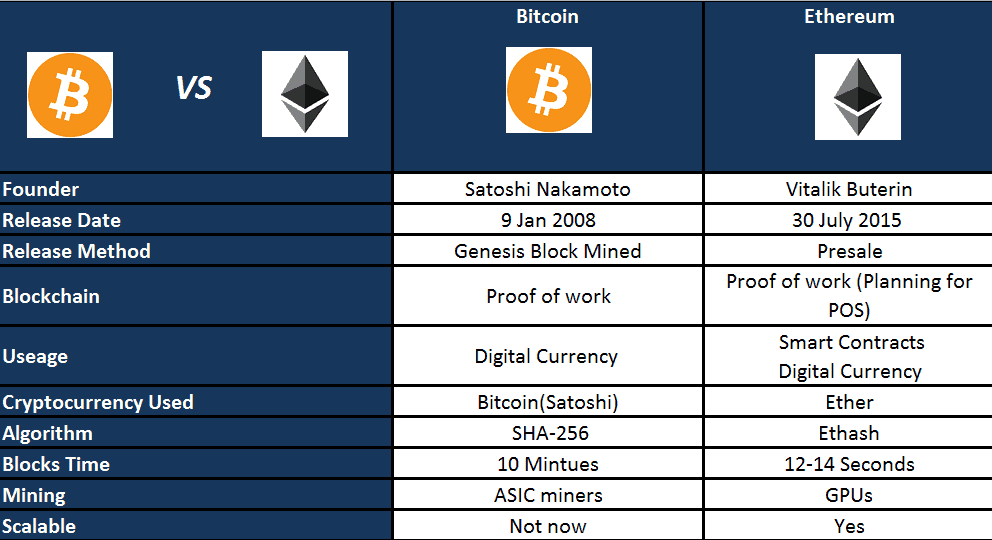

Bitcoin and Ether ETFs (Exchange-Traded Funds) represent a modern approach to investing in cryptocurrencies. These funds allow investors to gain exposure to Bitcoin and Ether without having to purchase the actual cryptocurrencies directly. Instead, they own shares in a fund that tracks the performance of these digital assets. The main purpose of Bitcoin and Ether ETFs is to simplify the investment process, making it more accessible to a broader range of investors while providing a regulated framework for trading.Bitcoin ETFs were among the first to gain traction, with funds like the ProShares Bitcoin Strategy ETF leading the way.

On the other hand, Ether ETFs have also gained popularity, with funds such as the Purpose Ether ETF. Both types of ETFs play a crucial role in the market by providing liquidity and enabling easier investment strategies for both retail and institutional investors.

Understanding ETF Outflows

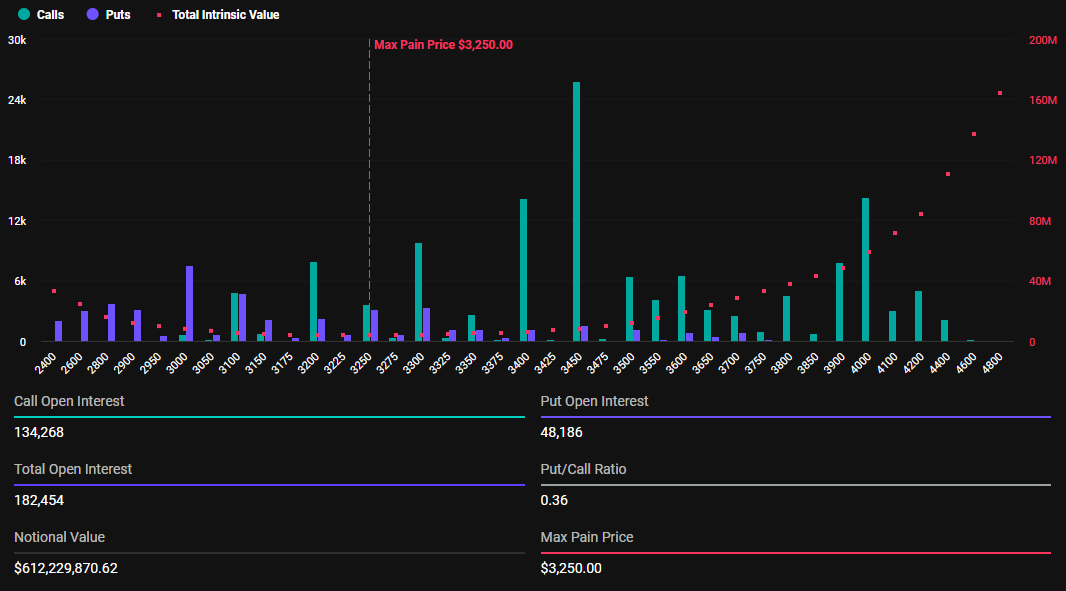

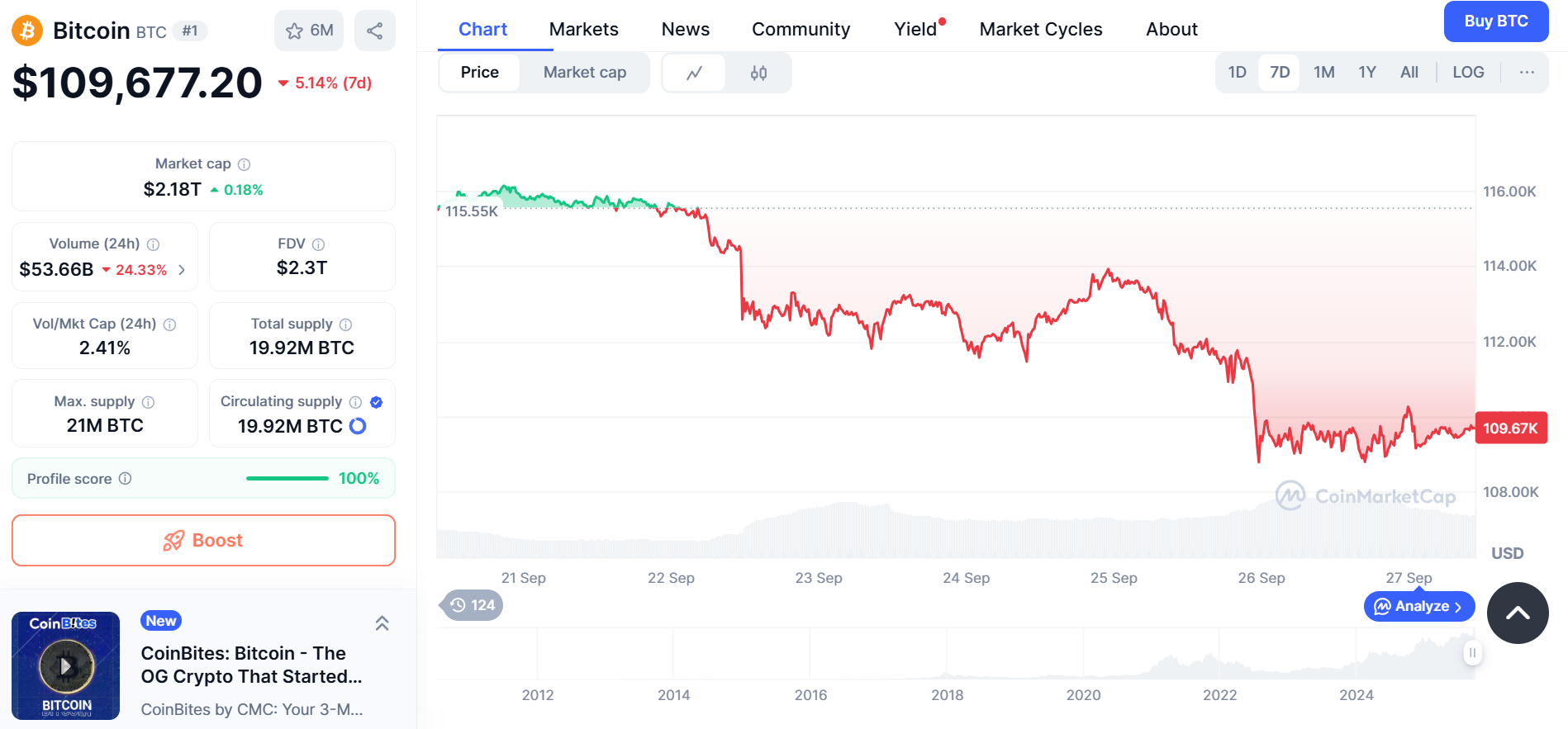

ETF outflows refer to the amount of money that is withdrawn from an exchange-traded fund, typically indicated by the number of shares sold. These outflows can significantly impact market dynamics, often resulting in price fluctuations as the underlying assets are sold to meet redemption requests. In the cryptocurrency market, outflows can reflect investor sentiment, with increasing outflows often signaling bearish trends or declining confidence in the asset.Recent trends in Bitcoin and Ether ETF outflows have shown varying patterns.

While Bitcoin ETFs have experienced notable outflows during periods of market volatility, Ether ETFs have had different responses, suggesting a divergence in investor sentiment between the two assets. Factors contributing to these outflows include macroeconomic conditions, regulatory changes, and shifts in market sentiment.

Recent Trends in Bitcoin and Ether ETF Outflows

Recent statistics indicate that Bitcoin ETFs have seen significant outflows in the past few months, with a notable spike during market corrections. Ether ETFs, in contrast, have shown more resilience but are not immune to outflows. The implications of these outflows on market prices are substantial, often leading to increased volatility and shifts in investor sentiment. To illustrate these trends, the following table showcases the monthly ETF outflows for Bitcoin and Ether over the past year:

| Month | Bitcoin ETF Outflows (in millions) | Ether ETF Outflows (in millions) |

|---|---|---|

| January | -150 | -50 |

| February | -100 | -20 |

| March | -200 | -30 |

| April | -50 | -10 |

| May | -300 | -70 |

| June | -100 | -40 |

| July | -250 | -60 |

| August | -150 | -20 |

| September | -180 | -15 |

| October | -120 | -25 |

Comparison of Bitcoin and Ether ETF Outflows

When comparing the outflow trends between Bitcoin and Ether ETFs, it’s clear there are distinct differences in patterns. Bitcoin has faced sharper and more frequent outflows, particularly during bearish market conditions, while Ether’s outflows tend to be less severe. This divergence can be attributed to several factors, including market maturity, investor demographics, and the perceived stability of each asset.Bitcoin’s status as the first cryptocurrency often leads to it being more susceptible to market panic.

In contrast, Ether, with its growing utility in decentralized applications and smart contracts, appears to retain a more loyal investor base, which could explain its relative resilience against outflows.

Impact of Regulatory Changes on ETF Outflows

Regulatory changes significantly influence the dynamics of Bitcoin and Ether ETFs. Recent developments, such as proposed legislation or SEC rulings, can lead to increased uncertainty, prompting investors to withdraw their funds. For instance, when the SEC delayed decisions on Bitcoin ETF applications, it led to a spike in outflows as investors sought to mitigate risks associated with regulatory uncertainties.Specific regulatory events can have immediate impacts on outflows.

A notable case occurred when the SEC announced stricter compliance requirements for crypto ETFs, resulting in a marked increase in outflows for several funds as investors reacted to the heightened regulatory scrutiny.

Investor Behavior and ETF Outflows

Investor psychology plays a crucial role in ETF outflows. Factors such as fear of missing out (FOMO) or fear and greed cycles can heavily influence decisions regarding investments in Bitcoin and Ether ETFs. Recent surveys indicate that a significant portion of investors remains cautious, especially during periods of high volatility, leading to increased outflows.To mitigate the effects of ETF outflows, investors can adopt several strategies, such as diversifying their portfolios, employing dollar-cost averaging, and staying informed about market trends and regulatory developments.

By understanding the underlying psychological factors, investors can navigate the complexities of ETF outflows more effectively.

Future Outlook for Bitcoin and Ether ETFs

Looking ahead, the future trends for Bitcoin and Ether ETFs regarding inflows and outflows will likely be shaped by several factors including regulatory clarity, market adoption, and technological advancements. As the cryptocurrency market continues to evolve, new developments could present both opportunities and challenges for ETF dynamics.Emerging trends that investors should watch for in Bitcoin and Ether ETFs include:

- Increased institutional adoption and investment in cryptocurrencies.

- Potential new ETF products targeting specific sectors within the crypto market.

- Improved regulatory frameworks that could enhance investor confidence.

- Growing interest in decentralized finance (DeFi) products linked to ETFs.

- Technological innovations that facilitate better fund management and liquidity.

Summary

In conclusion, understanding bitcoin ether etf outflows unveils a narrative of investor behavior, market trends, and the ever-evolving regulatory landscape. As we anticipate future developments in the cryptocurrency space, staying informed about these outflows can provide crucial insights for both seasoned and new investors. The shifting tides of these ETF outflows may well dictate the next chapter in the world of digital assets.

User Queries

What causes ETF outflows in Bitcoin and Ether?

ETF outflows can be triggered by various factors, including market volatility, investor sentiment, and significant regulatory changes that alter the perception of these assets.

How do outflows affect the price of Bitcoin and Ether?

Outflows often lead to decreased demand, which can exert downward pressure on the prices of Bitcoin and Ether, impacting overall market sentiment.

Are there any recent examples of regulatory changes influencing ETF outflows?

Yes, regulatory announcements or changes, such as increased scrutiny by financial authorities, have been linked to spikes in ETF outflows for both Bitcoin and Ether.

What strategies can investors use to mitigate the impact of ETF outflows?

Investors might diversify their portfolios, stay informed about market trends, and adjust their investment strategies based on ongoing analyses of ETF performance and outflows.

How can I track Bitcoin and Ether ETF outflows?

Investors can monitor ETF outflows through financial news outlets, cryptocurrency market analysis platforms, and specialized financial data services that provide regular updates and analytics.