Should I Sell My Ethereum And Buy Bitcoin For Profit

should i sell my ethereum and buy bitcoin serves as a pertinent question in the ever-evolving landscape of cryptocurrency. As traders and investors navigate the volatile waters of digital assets, understanding the fundamental differences and potential of Ethereum and Bitcoin becomes crucial. This discussion aims to unpack the intricacies of both cryptocurrencies, examining their historical performance, technological foundations, and current market trends.

With numerous factors affecting the cryptocurrency market, from macroeconomic indicators to community sentiment, this narrative explores whether now is the right time to pivot from Ethereum to Bitcoin. By analyzing various investment strategies and the risks involved, readers are equipped to make informed decisions in their trading journeys.

Overview of Ethereum and Bitcoin

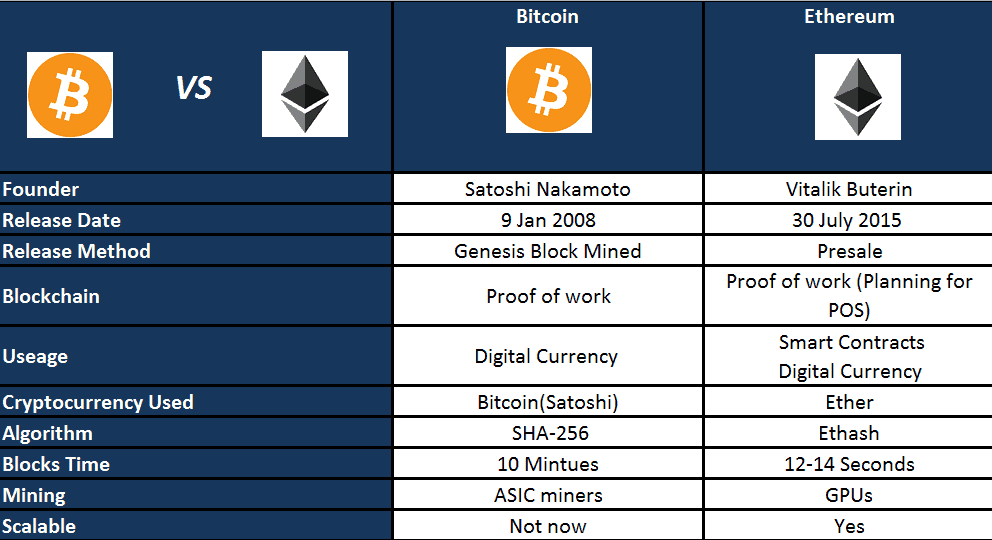

Cryptocurrencies have transformed the financial landscape, with Bitcoin and Ethereum leading the charge. While both are popular digital assets, they serve different purposes and come with unique features. Understanding these differences is crucial for any investor considering a trade between the two.Bitcoin, created in 2009, is primarily a digital currency designed for peer-to-peer transactions. It operates on a decentralized network and has a fixed supply of 21 million coins, making it a deflationary asset.

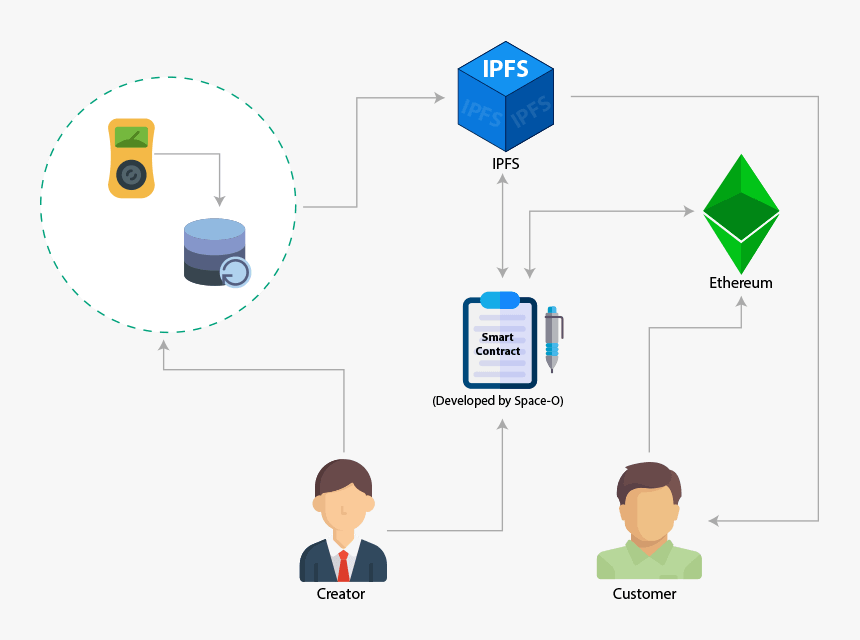

In contrast, Ethereum, launched in 2015, is more than just a cryptocurrency; it's a platform that enables smart contracts and decentralized applications (dApps). This fundamental difference positions Ethereum as a versatile technology rather than merely a currency.Historically, Bitcoin has seen dramatic price fluctuations, peaking at nearly $64,000 in April 2021 before experiencing significant corrections. Ethereum has also demonstrated substantial growth, reaching an all-time high of approximately $4,800 in November 2021.

The technology behind Bitcoin focuses on secure transactions, while Ethereum's blockchain supports complex programming, enabling a wide range of applications beyond simple currency exchanges.

Current Market Trends

As of now, both Bitcoin and Ethereum have been experiencing volatile market conditions. Bitcoin is trading in the range of $30,000, while Ethereum has seen prices around $2,000. The recent rise in interest rates has contributed to cautious investor sentiment, but the introduction of institutional investments into both cryptocurrencies has sparked renewed interest.Key factors influencing the current market conditions include macroeconomic indicators, regulatory news, and technological advancements.

For instance, the recent approval of a Bitcoin ETF has created a buzz in the market, uplifting both assets. However, regulatory concerns remain a significant point of contention, impacting investor confidence and market stability.Recent news articles highlight how major companies are exploring blockchain technology and cryptocurrencies, further fueling interest. Events such as these emphasize the dynamic nature of the crypto market and the potential for both Bitcoin and Ethereum to benefit from increased mainstream adoption.

Investment Strategies

When considering whether to sell Ethereum to buy Bitcoin, it's essential to craft a comprehensive investment strategy. Investors should assess their risk tolerance and long-term financial goals. Holding Ethereum offers exposure to a broader range of applications, while Bitcoin is often viewed as a store of value.Benefits of including both cryptocurrencies in a portfolio are clear. Bitcoin provides stability and a strong historical performance, while Ethereum’s growth potential lies in its innovative applications.

A diversified approach may yield better results than concentrating on a single asset.Here's a simplified risk assessment for selling Ethereum to buy Bitcoin:

- Market Volatility: Both cryptocurrencies are subject to rapid price changes.

- Opportunity Cost: Selling Ethereum might lead to missing out on future growth.

- Regulatory Risks: Changing regulations can impact both assets differently.

- Technological Factors: Ethereum's upgrades could enhance its value compared to Bitcoin.

Economic Factors to Consider

Macroeconomic indicators play a significant role in shaping the cryptocurrency market. Inflation rates, interest rates, and economic policies impact investor behavior. For example, rising inflation often drives investors toward alternative assets like cryptocurrencies, seeking to hedge against currency devaluation.The interplay between economic conditions and cryptocurrency investments is crucial. In an environment of low interest rates, the appeal of holding assets like Bitcoin increases, as traditional savings accounts yield minimal returns.

Conversely, higher interest rates can lead to a withdrawal of capital from riskier assets.Current global market trends, such as supply chain disruptions and geopolitical tensions, further influence cryptocurrency prices. These factors create an uncertain environment, making it essential for investors to remain informed.

Technical Analysis

Technical analysis is a vital tool for evaluating price movements in cryptocurrencies. Utilizing various indicators and chart patterns can provide insights into potential trading opportunities. Key tools include moving averages, the Relative Strength Index (RSI), and Fibonacci retracement levels.To perform a basic technical analysis on both Ethereum and Bitcoin, follow these steps:

- Identify the current trend using moving averages.

- Examine price action and identify support and resistance levels.

- Analyze momentum indicators like the RSI to determine overbought or oversold conditions.

- Look for chart patterns such as triangles or head and shoulders to predict future movements.

By employing these tools, investors can make informed decisions about entry and exit points when trading either cryptocurrency.

Community and Sentiment Analysis

Community sentiment plays a crucial role in cryptocurrency markets. Social media platforms and forums provide a wealth of information on current opinions regarding Bitcoin and Ethereum. Sentiment analysis can help gauge market mood and investor confidence.Recent trends indicate that positive sentiment often correlates with price increases, while negative news can lead to sharp declines. Influential figures in the cryptocurrency space, such as renowned analysts and industry leaders, can sway public opinion significantly.

Their perspectives often shape market movements, making it vital for investors to monitor these sentiments closely.

Risks and Challenges

Trading cryptocurrencies comes with inherent risks. Price volatility is a significant challenge, as both Ethereum and Bitcoin can experience drastic fluctuations in short periods. Regulatory challenges are also a concern, as governments worldwide grapple with how to regulate digital assets effectively.Security remains a paramount issue in the crypto space. Investors must be vigilant against scams and hacking incidents, as the decentralized nature of cryptocurrencies can sometimes lead to vulnerabilities.

Ensuring robust security measures and understanding market dynamics are key to mitigating these risks.

Long-term vs Short-term Holding

Long-term investment strategies in cryptocurrencies can yield substantial rewards. Bitcoin, viewed as digital gold, appeals to investors seeking stability, while Ethereum offers growth potential through its technological advancements and ecosystem developments. Here's a table contrasting short-term trading strategies for both cryptocurrencies:

| Strategy | Bitcoin | Ethereum |

|---|---|---|

| Day Trading | High liquidity, often stable | More volatile, potential for high returns |

| Scalping | Frequent small profits | Fast-moving opportunities |

| HODLing | Strong historical growth | Innovative applications may lead to significant appreciation |

Deciding whether to hold or sell in the current market depends on individual investment goals and market conditions.

Future Predictions

Looking ahead, both Ethereum and Bitcoin are poised for further technological developments. Ethereum's transition to Ethereum 2.0 aims to improve scalability and reduce energy consumption, potentially enhancing its value. Bitcoin, with halving events, historically experiences price increases, offering bullish prospects.Market analysts forecast continued growth for both cryptocurrencies in the coming years, with predictions of Bitcoin reaching $100,000 and Ethereum potentially hitting $10,000.

The impact of events such as the upcoming Bitcoin halving or Ethereum upgrades could significantly influence trading decisions, making it essential for investors to stay informed about these developments.

Concluding Remarks

In conclusion, the decision to sell Ethereum and buy Bitcoin hinges on a multitude of factors, including individual investment goals, market conditions, and future predictions of both cryptocurrencies. As the digital landscape continues to evolve, staying informed and adaptable is key to maximizing potential returns. Ultimately, whether you choose to hold or trade, understanding the core differences and market trends will empower you to make the best choice for your portfolio.

FAQ Guide

What are the main differences between Ethereum and Bitcoin?

Ethereum is focused on smart contracts and decentralized applications, while Bitcoin is primarily a digital currency used for transactions.

Is it safe to trade cryptocurrencies?

Trading cryptocurrencies involves risk, including market volatility, but using secure platforms and following best practices can mitigate some dangers.

How do macroeconomic factors affect cryptocurrency prices?

Macroeconomic factors like inflation, interest rates, and global economic conditions can influence investor sentiment and price movements in the cryptocurrency market.

What are the potential risks of selling Ethereum to buy Bitcoin?

Potential risks include missing out on Ethereum’s future growth, market volatility during the transition, and regulatory changes that could impact both assets.

What tools are best for technical analysis of cryptocurrencies?

Popular technical analysis tools include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) for evaluating price trends.